BHP Xplor, an accelerator program introduced by the miner in August 2022 to help grow its portfolio of what it calls forward facing commodities, will launch a second round in September, which will focus on copper and nickel-related projects exclusively, the head of the initiative said.

Sonia Scarselli, BHP Xplor’s VP, said the first cohort will be gathering in Brisbane, Australia, during the last week of June for an external showcase. The event signifies the end of the six-month program that helped them to take their ideas from concept to a more defined project.

The other goal of the program, Scarselli told MINING.COM, is to change the way BHP and the industry in general have been investing in the junior space.

What the world’s largest miner gains with this experience, she noted, is to see first and potentially capture an opportunity to grow its portfolio of forward facing commodities, key to support the world’s needed energy transition. It also allows BHP to tap into new jurisdictions.

“We hope to create disruptive results in copper and nickel exploration by identifying new concepts, leveraging new data and testing opportunities at a much faster pace than discoveries to date,” Scarselli said.

BHP expects the world to need twice the amount of copper presently produced by 2030, and four times the current supply of nickel.

At the pace investment in exploration and juniors has been growing in the past decade, Scarselli says, supply of those key metals won’t be enough.

Experts have long warned that the world needs to invest a gigantic amount, so far estimated at more than $100 billion, to build mines able to close an annual supply deficit of roughly 5 million tonnes of copper by 2030.

This may explain why the orange metal is rapidly becoming the go-to commodity for investors looking for exposure to the energy transition.

According to Max Layton, Citi’s managing director for commodities research, they are likely to pile in quickly as soon as the global growth outlook starts to improve. That will set the stage for a buying frenzy as orders from electric cars makers and grid operators flood in, he said in an interview this week.

“If you want to put on a decarbonization trade in commodities, the only truly liquid commodity is copper, and it’s the most liquid by a country mile,” Layton said. “Copper’s unique characteristics mean that it could make oil’s 2008 bull run look like child’s play.”

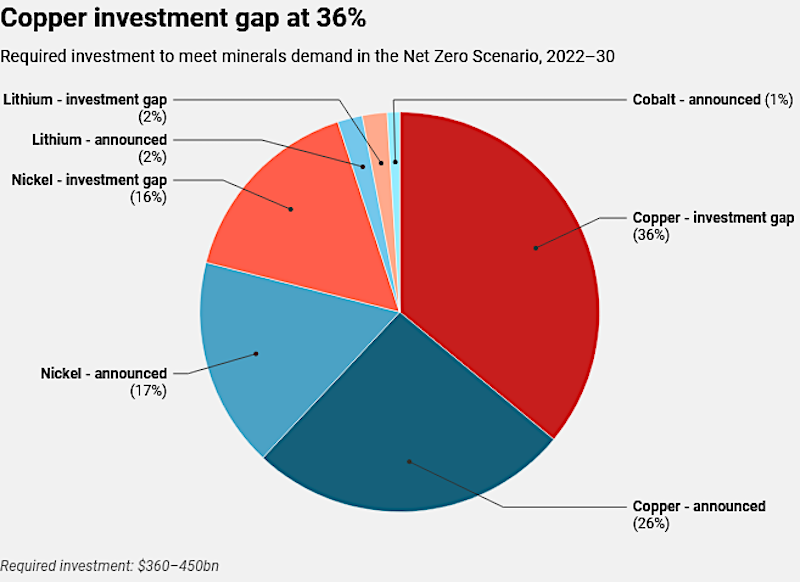

When taking into account other metals and minerals, including lithium, nickel and cobalt, the required investment in critical raw materials globally is pegged at between $360 and $450 billion, the International Energy Agency (IEA) said in a May report.

Anticipated investment in critical minerals mining globally, the agency noted, is estimated in only $180 to $220 billion.

The looming copper shortage may also explain why BHP’s Xplor is only interested in copper and nickel projects for now. Xplore has a more short term focus says Scarselli although BHP’s strategy has always been to identify and monitor commodities in which the company can build a market profile from a strategic point of view.

Graduating class

The idea of introducing an accelerator program was born in June 2022. BHP launched it at the end of August and by September it had received 500 applications, more than they ever expected, according to Scarselli.

After short-listing 50 of them for a phone interview and then 15 for in-person meetings, BHP chose seven.

Since January, XPlor has given $500,000 each to Nordic Nickel, Tutume Metals, Asian Battery Minerals, Impact Minerals, Red Ox Copper, Bronzite Corp and Kingsrose Mining.

BHP has also shared knowledge and offered the selected companies the opportunity to establish a long-term partnership with the company and its global network of partners.

“The idea is to let companies focus completely on their concept, instead of on raising capital,” Scarselli explained.

For its second year, the program wants to receive double the number of applications from the first year. It also hope to announce the winners in December.

Asked what will happen to the first cohort of companies after the six-month period ends, the BHP executive said her team will negotiate with each company on a case-by-case scenario.

“Some may not want to continue working together, in some other cases we may stay as the operator or even buy the project or the company. It has to be done as part of an ongoing conversation,” Scarselli said.

To those planning to apply in September, the BHP executive, who has made explorations and projects appraisals her focus since 2019, has a simple message: to think outside the box.

“I encourage them to present a novel geological concept, a new idea for the resources that exist in a particular area,” she said. “Transparency about what they know and what they do not know is also key — it doesn’t matter if they do not know some aspects; that can be part of BHP’s involvement in the project.”